IRS announces Tax Law Changes for 2021

IRS announces Tax Law Changes for 2021

MOST COMMON CHANGES

1- Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18,

1a- All taxpayers now eligible for Identity Protection PIN. Beginning in 2021, the IRS Identity Protection PIN (IP PIN) Opt-In Program has been expanded to all taxpayers who can properly verify their identity. An IP PIN helps prevent your social security number from being used to file a fraudulent federal income tax return. You can use the Get An IP PIN tool on IRS.gov to request an IP PIN, file Form 15227

2- Tuition and fees deduction not available. The tuition and fees deduction is not available after 2020. Instead, the income limitations for the lifetime learning credit have been increased.

3- Economic impact payment—EIP 3. Any economic impact payment you received is not taxable for federal income tax purposes, but will reduce your recovery rebate credit. 2021 Recovery Rebate Credit. This credit is figured like last year's economic impact payment, EIP 3, except eligibility and the amount of the credit are based on your tax year 2021 information

4- Virtual Currency: If, in 2021, you engaged in a transaction involving virtual currency, you will need to answer “Yes” to the question on page 1 of Form 1040 or 1040-SR. Do not leave this field blank. The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency.

5- Expanded Dependent Care Assistance: The ARP expanded the child and dependent care tax credit for 2021 by making it refundable for certain taxpayers and making it larger. For 2021, the dollar limit on qualifying expenses increases to $8,000 for one qualifying person and $16,000 for two or more qualifying persons. The rules for calculating the credit have also changed; the percentage of qualifying expenses eligible for the credit has increased, along with the income limit at which the credit begins phasing out. Additionally, for taxpayers who receive dependent care benefits from their employer, the dollar limit of the exclusion amount increases for 2021

6- Child Tax Credit. Under the ARP, the child tax credit has been enhanced for 2021. The child tax credit has been extended to qualifying children under age 18. Depending on modified adjusted gross income, you may receive an enhanced credit amount of up to $3,600 for a qualifying child under age 6 and up to $3,000 for a qualifying child over age 5 and under age 18. The enhanced credit amount begins to phase out where modified adjusted gross income exceeds $150,000 in the case of a joint return or surviving spouse, $112,500 in the case of a head of household, and $75,000 in all other cases. If you (or your spouse if filing jointly) lived in the United States for more than half the year, the child tax credit will be fully refundable even if you don't have earned income. If you don't meet this residency requirement, your child tax credit will be a combination of a nonrefundable child tax credit and a refundable additional child tax credit, as was the case in 2020. The credit for other dependents has not been enhanced and is figured as it was in 2020.

CAUTION ! Schedule 8812 (Form 1040) 8862 Improper Claims If you erroneously claim the RCTC, NCTC, ACTC, or ODC, and it is later determined that your error was due to reckless or intentional disregard of the RCTC, NCTC, ACTC, or ODC rules, you will not be allowed to claim any of these credits for 2 years. If it is determined that your error was due to fraud, you will not be allowed to claim any of these credits for 10 years. You may also have to pay penalties. Form 8862 may be required. If your RCTC, NCTC, ACTC, or ODC for a year after 2015 was denied or reduced for any reason other than a math or clerical error, you must attach Form 8862 to your tax return to claim the RCTC, NCTC, ACTC, or ODC, unless an exception applies. See Form 8862, Information

Child Tax received in Advance Client Must bring Letter 6419. If you received advance child tax credit payments during 2021, you will receive Letter 6419. Keep this notice for your records. You will use the information from this notice to figure the amount of child tax credit to claim on your 2021 tax return or the amount of additional tax you must report on Schedule 2 (Form 1040). Additional tax on excess advance child tax credit payments. If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 (Form 1040) are less than what you received, you may owe an additional tax. Complete Schedule 8812 (Form 1040) to determine if you must report an additional tax on Schedule 2 (Form 1040).

7- Other Credits:

- Student Loan Interest Deduction. The $2,500 deduction for interest paid on student loans begins to phase out when modified adjusted gross income hits $70,000 ($145,000 for joint returns) and is completely phased out when MAGI hits $85,000 ($175,000 for joint returns).

- Elementary and Secondary School Teachers Expenses. In 2022, qualifying teachers can claim $300 for expenses paid or incurred for books, supplies (other than nonathletic supplies for courses of instruction in health or physical education), computer equipment (including related software and services) and other equipment, and supplementary materials used in the classroom. That’s up from $250 in 2021

- Commuter benefits. The monthly limit for 2022 contributions to qualified parking and transit accounts is $280. If you pay to park and ride, you get to double dip.

- Flexible Savings Accounts. The dollar limit for 2022 contributions to a flexible savings account is $2,850. For plans that allow carryovers, the carryover limit is $570.

Premium tax credit (PTC). The ARP expanded the PTC by eliminating the limitation that a taxpayer's household income may not exceed 400% of the federal poverty line and generally increases the credit amounts. In addition, in 2021, if you receive unemployment compensation, you are generally eligible to claim the PTC if you meet the other requirements. For more information, see IRS Publication 17.

Adoption credit. The tax credit for an adoption of a child with special needs is $14,890 for 2022. The maximum credit allowed for other adoptions is the amount of qualified adoption expenses up to $14,890. The credit begins to phase out for taxpayers with modified adjusted gross income (MAGI) in excess of $223,410, and it’s completely phased out at $263,410 or more.

Lifetime Learning Credit. This education tax credit is phased out for single taxpayers with MAGI in excess of $80,000, and for joint filers with $160,000, for 2022.

Forgiveness of Paycheck Protection Program (PPP) loans. The forgiveness of a PPP loan creates tax-exempt income, so you don't need to report the income on Form 1040 or 1040-SR, but you do need to report certain information related to your PPP loan.

Child and Dependent Care Credit:

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. Generally, you may not take this credit if your filing status is married filing separately, which describes an exception for certain taxpayers living apart from their spouse and meeting other requirements. The amount of the credit is a percentage of the amount of work-related expenses you paid to a care provider for the care of a qualifying individual. The percentage depends on your adjusted gross income. In 2021, for the first time, the credit is fully refundable. This means that an eligible family can get it, even if they owe no federal income tax.

Dollar Limit

For 2021 only, the total expenses that you may use to calculate the credit may not be more than $8,000 (for one qualifying individual) or $16,000 (for two or more qualifying individuals). Expenses paid for the care of a qualifying individual are eligible expenses if the primary reason for paying the expense is to assure the individual's well-being and protection. If you received dependent care benefits that you exclude or deduct from your income, you must subtract the amount of those benefits from the dollar limit that applies to you.

Qualifying Individual

A qualifying individual for the child and dependent care credit is: • Your dependent qualifying child who was under age 13 when the care was provided, • Your spouse who was physically or mentally incapable of self-care and lived with you for more than half of the year, or • An individual who was physically or mentally incapable of self-care, lived with you for more than half of the year, and either: (a) was your dependent; or (b) could have been your dependent except that he or she received gross income of $4,300 or more, or filed a joint return, or you (or your spouse, if filing jointly) could have been claimed as a dependent on another taxpayer's 2021 return.

Physically or Mentally Not Able to Care for Oneself - An individual is physically or mentally incapable of self-care if, as a result of a physical or mental defect, the individual is incapable of caring for his or her hygiene or nutritional needs or requires the full-time attention of another person for the individual's own safety or the safety of others.

Children of Divorced or Separated Parents or Parents Living Apart - A noncustodial parent who is claiming a child as a dependent should review the rules under the topic Child of divorced or separated parents or parents living apart in Publication 503 PDF, because a child may be treated as the qualifying individual of the custodial parent for the child and dependent care credit, even if the noncustodial parent is entitled to claim the child as a dependent.

Individual Qualifying for Part of Year - If an individual is a qualifying individual for only a part of the tax year, only those expenses paid for care of the individual during that part of the year are included in calculating the credit.

Taxpayer Identification Number (TIN) - You must provide the TIN (usually the social security number) of each qualifying individual.

Care of a Qualifying Individual

The care may be provided in the household or outside the household; however, don't include any amounts that aren't primarily for the well-being of the individual. You should divide the expenses between amounts that are primarily for the care of the individual and amounts that aren't primarily for the care of the individual. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross income. In general, for 2021, you can exclude up to $10,500 for dependent care benefits received from your employer. Additionally, in general, the expenses claimed may not exceed the smaller of your earned income or your spouse's earned income. If you or your spouse is a full-time student or incapable of self-care, then you or your spouse is treated as having earned income for each month that you or your spouse is a full-time student or incapable of self-care. Your or your spouse’s earned income for each month is $250 if there is one qualifying person ($500 if two or more qualifying individuals).

Care Providers

You must identify all persons or organizations that provide care for your child or dependent. You must report the name, address, and TIN (either the social security number or the employer identification number) of the care provider on your return. If the care provider is a tax-exempt organization, you need only report the name and address of the organization on your return. If you can't provide information regarding the care provider, you may still be eligible for the credit if you can show that you exercised due diligence in attempting to provide the required information. If you pay a provider to care for your dependent or spouse in your home, you may be a household employer. If you're a household employer, you may have to withhold and pay social security and Medicare taxes and pay federal unemployment tax.

Payments to Relatives or Dependents - The care provider can't be your spouse, the parent of your qualifying individual if your qualifying individual is your child and under age 13, your child who is under the age of 19, or a dependent whom you or your spouse may claim on your return.

Changes to the earned income credit (EIC).

For 2021, the following changes have been made to the EIC.

- EIC rules for taxpayers without a qualifying child. Special rules apply if you are claiming the EIC without a qualifying child. In these cases, the minimum age has been lowered to age 19 except for specified students who must be at least age 24 at the end of the year. However, the applicable minimum age is lowered further for former foster youth and qualified homeless youth to age 18. Additionally, you no longer need to be under age 65 to claim the EIC without a qualifying child.

- EIC rules for taxpayers with a qualifying child. If you are claiming the EIC with a qualifying child, you should follow the rules that apply to filers with a qualifying child or children when determining whether you are eligible to claim the EIC even if your qualifying child hasn't been issued a valid SSN on or before the due date of your return (including extensions). However, when determining the amount of EIC that you are eligible to claim on your return, you should follow the rules that apply to taxpayers who do not have a qualifying child.

- Phaseout amounts increased. The amount of the credit has been increased and the phaseout income limits at which you can claim the credit have been expanded.

- Rules for separated spouses. If you are married but don't file a joint return, you may qualify to claim the EIC if you live with a qualifying child for more than half the year and either live apart from your spouse for the last 6 months of 2021 or are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and do not live in the same household as your spouse at the end 2021

Investment income limit increased. The amount of investment income you can receive and still be eligible to claim the EIC has increased to $10,000.

2A- Prior year (2019) earned income. You can elect to use your 2019 earned income to figure your 2021 earned income credit if your 2019 earned income is more than your 2021 earned income

Identity verification

The IRS launched an improved identity verification and sign-in process that enables more people to securely access and use IRS online tools and applications. To provide verification services, the IRS is using ID.me, a trusted technology provider. The new process is one more step the IRS is taking to ensure that taxpayer information is provided only to the person who legally has a right to the data. Taxpayers using the new mobile-friendly verification procedure can gain entry to existing IRS online services such as the Child Tax Credit Update Portal, On-line Account, Get Transcript Online, Get an Identity Protection PIN (IP PIN), and Online Payment Agreement. Additional IRS applications will transition to the new method over the next year. Each online service will also provide information that will instruct taxpayers on the steps they need to follow for access to the service

Personal protective equipment (PPE). Amounts paid for PPE, such as masks, hand sanitizer, and sanitizing wipes, for the primary purpose of preventing the spread of coronavirus, are qualified medical expenses. If the amounts were paid or reimbursed under a health flexible spending account, Archer medical savings account, health reimbursement arrangement, or any other health plan, the amounts are not deductible on Schedule A (Form 1040).

Popular Tax Deductions

Standard mileage rates for Medical. The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons decreased to 16 cents a mile. The 2021 rate for use of your vehicle to do volunteer work for certain charitable organizations remains at 14 cents a mile and the rate for business use of a vehicle is 56 cents a mile.

Business meals. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100% business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31, 2020, and before January 1, 2023.

Personal Exemption Amount

SThe personal exemption amount remains zero in 2022. The Tax Cuts and Jobs Act suspended the personal exemption through tax year 2025, balancing the suspension with an enhanced Child Tax Credit for most taxpayers and a near doubling of the standard deduction amount.

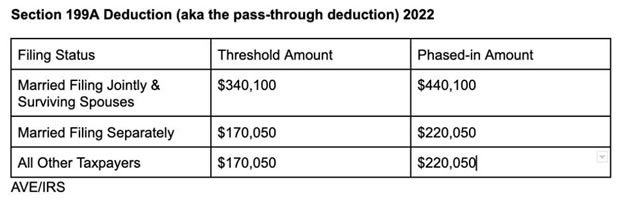

Section 199A deduction (also called the pass-through deduction)

As part of the Tax Cuts & Jobs Act, sole proprietors and owners of pass-through businesses are eligible for a deduction of up to 20% to lower their tax rate for qualified business income. Here are the threshold and phase-in amount for the deduction for 2022:

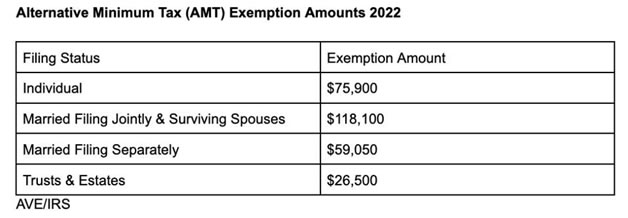

Alternative Minimum Tax Exemption Amounts

Here’s what the alternative minimum tax (AMT) exemption amounts look like for 2022, adjusted for inflation:

Kiddie Tax

A child’s unearned income is taxed at the parent’s marginal tax rate; that tax rule has been dubbed the “kiddie tax.” The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24. Unearned income is income from sources other than wages and salary. For example, unearned income includes dividends and interest, inherited Individual Retirement Account distributions and taxable scholarships.

For 2022, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,150 or (2) the sum of $400 and the individual’s earned income (not to exceed the regular standard deduction amount). If your child’s only income is unearned income, you may be able to elect to include that income on your tax return rather than file a separate return for your child. This is allowed for 2022 if the child’s gross income is more than $1,150 but less than $11,500. But the tax bite may be less if your child files a separate return.

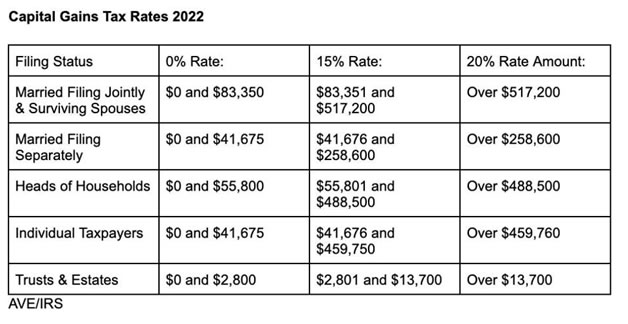

Capital Gains Tax

Capital gains tax rates remain the same for 2022, but the brackets for the rates will change. Here’s a breakdown of long-term capital gains and qualified dividends rates for taxpayers based on their taxable income:

IRA Contribution and Deducations:

Next year taxpayers can put an extra $1,000 into their 401(k) plans. The IRS recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. The agency also announced cost of living adjustments that may affect pension plan and other retirement-related savings next year.

Highlights of changes for 2022

The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan is increased to $20,500. Limits on contributions to traditional and Roth IRAs remains unchanged at $6,000.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If neither the taxpayer nor their spouse is covered by a retirement plan at work, their full contribution to a traditional IRA is deductible. If the taxpayer or their spouse was covered by a retirement plan at work, the deduction may be reduced or phased out until it is eliminated. The amount of the deduction depends on the taxpayer's filing status and their income.

Traditional IRA income phase-out ranges for 2022 are:

- $68,000 to $78,000 - Single taxpayers covered by a workplace retirement plan

- $109,000 to $129,000 - Married couples filing jointly. This applies when the spouse making the IRA contribution is covered by a workplace retirement plan.

- $204,000 to $214,000 - A taxpayer not covered by a workplace retirement plan married to someone who's covered.

- $0 to $10,000 – Married filing a separate return. This applies to taxpayers covered by a workplace retirement plan

Roth IRA contributions income phase-out ranges for 2022 are:

- $129,000 to $144,000 - Single taxpayers and heads of household

- $204,000 to $214,000- Married, filing jointly

- $0 to $10,000 - Married, filing separately

Saver's Credit income phase-out ranges for 2022 are:

- $41,000 to $68,000 – Married, filing jointly.

- $30,750 to $51,000 – Head of household.

- $20,500 to $34,000 – Singles and married individuals filing separately.

The amount individuals can contribute to SIMPLE retirement accounts also increases to $14,000 in 2022.

Roth IRAs and designated Roth accounts only accept rollovers of money that has already been taxed. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Withdrawals from a Roth IRA or designated Roth account, including earnings, will be tax-free if you:

- have held the account for at least 5 years, and

- are:

- age 59½ or older;

- disabled; or

- deceased.

In addition, you can get a tax-free distribution after 5 years from a Roth IRA of up to $10,000 to buy your first home.

401K Contribution limit

$20,500

Workers who are younger than age 50 can contribute a maximum of $20,500 to a 401(k) in 2022. That's up $1,000 from the limit of $19,500 in 2021. If you're age 50 and older, you can add an extra $6,500 per year in "catch-up" contributions, bringing your total 401(k) contributions for 2022 to $27,000.

What is the Max Roth contribution for 2022?

$6,000

The maximum amount you can contribute to a Roth IRA for 2022 is $6,000 if you're younger than age 50. If you're age 50 and older, you can add an extra $1,000 per year in "catch-up" contributions, bringing the total contribution to $7,000. This remains unchanged from 2019. Once you turn 50, you become eligible to make additional catch-up contributions of up to $6,500 to your 401(k) plan, for a total of $27,000 you can temporarily shield from income tax.

What is the maximum 457 contribution for 2022 for over 50?

If you're 50 or older, your plan may allow you to contribute an additional $6,500 as a "catch-up" contribution, bringing your contribution total to $27,000. There's also a separate catch-up contribution that benefits soon-to-be retirees, if permitted by the 457 plan.

Individual Retirement Arrangements (IRAs)

What’s New Modified AGI limit for traditional IRA contributions. For 2021, if you are covered by a retirement plan at work, your deduction for contributions to a traditional IRA is reduced (phased out) if your modified AGI is:

- More than $105,000 but less than $125,000 for a married couple filing a joint return or a qualifying widow(er),

- More than $66,000 but less than $76,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

If you either live with your spouse or file a joint return, and your spouse is covered by a retirement plan at work but you aren’t, your deduction is phased out if your modified AGI is more than $198,000 but less than $208,000. If your modified AGI is $208,000 or more, you can’t take a deduction for contributions to a traditional IRA. See How Much Can You Deduct, later. Modified AGI limit for Roth IRA contributions. For 2021, your Roth IRA contribution limit is reduced (phased out) in the following situations.

Is the backdoor Roth going away in 2022?

Starting in 2022, the bill had proposed to end so-called non-deductible backdoor and mega backdoor Roth conversions. Regardless of income level, you'd no longer be able to convert after-tax contributions made to a 401(k) or a traditional IRA to a Roth IRA.

Backdoor' Roth restrictions have been put on hold -- for now

BBB Sought to End the Abuse of Roth Retirement Accounts

A high-profile part of the Build Back Better legislation would have stopped the uber-wealthy from taking advantage of Roth IRAs which were authorized in the late 1990s to help middle-class Americans save for retirement. Contributions made to Roth IRAs are made after you’ve paid income taxes on the money. In other words, the money you save is taxed upfront, enabling the biggest Roth IRA Benefit: Withdrawals down the road are free of federal income tax, no matter how much your investments have gained. Most Possible Outcome could be : No Portion of Build Back Better is Enacted in 2022

What is Mega Backdoor Roth IRA:

A mega backdoor Roth is a special type of 401(k) rollover strategy used by people with high incomes to deposit funds in a Roth individual retirement account (IRA). This little-known strategy only works under very particular circumstances for people with plenty of extra money they would like to stash in a Roth IRA. If that’s you, here’s what you need to know.

How Does a Mega Backdoor Roth Work?

A mega backdoor Roth lets you roll over up to $45,000 from a traditional 401(k) to a Roth IRA, all without paying any taxes you’d normally owe with such a conversion.

Note that pursuing this strategy only makes sense if you’ve already maxed out your annual 401(k) and IRA contributions and you still have a relatively large chunk of cash that you’d like to get into a Roth IRA.

In addition, you must be enrolled in an employer-sponsored traditional 401(k) plan that permits after-tax contributions and in-service withdrawals.

- After-tax contributions. Once you have maxed out your employee 401(k) contribution limit for the year, some plans allow additional after-tax contributions. As the name suggests, these contributions comprise money that’s already been taxed. Roth contributions are similar, but earnings on after-tax contributions are taxable upon withdrawal, while Roth earnings are free of tax. Why make after-tax contributions? They can still help you avoid capital gains taxes.

- In-service withdrawals. Most but not all 401(k) plans let participants take withdrawals from their accounts while they’re still employed. These in-service withdrawals are a necessary part of the mega backdoor Roth process: You make after-tax contributions, then immediately take an in-service withdrawal before the contributions generate returns that would be taxable during a rollover. If your plan does not permit in-service withdrawals, you can still do a mega backdoor Roth after you leave your current job, but you’ll probably owe taxes on any investment earnings during a rollover. If you’re self-employed and use a solo 401(k) plan,, you may be ahead of the game. Not all major solo 401(k) providers allow for after-tax contributions and in-service withdrawals by default. But if yours doesn’t, you may be able to customize your plan relatively easily and inexpensively to allow for these. 401(k) Contribution Limits Are Key to the Mega Backdoor Roth Remember, you can’t make the after-tax contributions required for a mega backdoor Roth until you’ve reached your 401(k) employee contribution limit. That’s $19,500 in 2021, or $26,000 if you’re 50 or older. This isn’t the only 401(k) contribution limit that exists, though. Your employer also has one: It can contribute up to enough to bring your total contribution to $58,000, or $64,500 if you are 50 or older. If your company isn’t maxing out its part of the deal, you may be able to make up the difference with your own after-tax contributions. Assuming no employer contributions, the maximum you can contribute this way is $39,500 (or $45,000 for people 50 or older) in 2021. But chances are your employer is contributing some amount to your future. Here’s the mega backdoor Roth math could work: Take someone who’s younger than 50 and has maxed out their annual traditional 401(k) contribution. This individual’s employer offers a standard 6% matching contribution. $19,500 individual contribution + $1,170 employer match = $20,670 • $58,000 401(k) total limit – $20,670 in standard contributions = $37,330 available for after-tax contributions Once you have your after-tax contribution maximum, you’ll want to contribute up to that amount to your traditional 401(k) and then roll that amount over into a Roth IRA at the brokerage of your choice. Any standard pre-tax contributions should remain in your 401(k) account, unless you want to pay taxes to convert them as well.

Complete the Rollover Before Earnings Accrue

You want to roll over your money as soon as possible because you want to minimize the likelihood your funds see any investment returns as these will be taxed in the conversion.

If your after-tax contributions do end up generating investment growth, the IRS allows you to split up the funds, rolling the after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA.

Modified AGI limit for traditional IRA contributions. For 2021, if you are covered by a retirement plan at work, your deduction for contributions to a traditional IRA is reduced (phased out) if your modified AGI is: • More than $105,000 but less than $125,000 for a married couple filing a joint return or a qualifying widow(er), • More than $66,000 but less than $76,000 for a single individual or head of household, or • Less than $10,000 for a married individual filing a separate return. If you either live with your spouse or file a joint return, and your spouse is covered by a retirement plan at work but you aren’t, your deduction is phased out if your modified AGI is more than $198,000 but less than $208,000. If your modified AGI is $206,000 or more, you can’t take a deduction for contributions to a traditional IRA.

Modified AGI limit for Roth IRA contributions. For 2021, your Roth IRA contribution limit is reduced (phased out) in the following situations. • Your filing status is married filing jointly or qualifying widow(er) and your modified AGI is at least $198,000. You can’t make a Roth IRA contribution if your modified AGI is $208,000 or more. • Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2021 and your modified AGI is at least $125,000. You can’t make a Roth IRA contribution if your modified AGI is $140,000 or more. • Your filing status is married filing separately, you lived with your spouse at any time during the year, and your modified AGI is more than zero. You can’t make a Roth IRA contribution if your modified AGI is $10,000 or more. See Can You Contribute to a Roth IRA

RECORD KEEPING

Why Keep Records? Good records help you:

- Identify sources of income. Your records can identify the sources of your income to help you separate business from nonbusiness income and taxable from nontaxable income.

- Keep track of expenses. You can use your records to identify expenses for which you can claim a deduction. This helps you determine if you can itemize deductions on your tax return.

- Keep track of the basis of property. You need to keep records that show the basis of your property. This includes the original cost or other basis of the property and any improvements you made.

- Prepare tax returns. You need records to prepare your tax return.

- Support items reported on tax returns. The IRS may question an item on your return. Your records will help you explain any item and arrive at the correct tax. If you can’t produce the correct documents, you may have to pay additional tax and be subject to penalties.

Kinds of Records To Keep The IRS doesn't require you to keep your records in a particular way. Keep them in a manner that allows you and the IRS to determine your correct tax. You can use your checkbook to keep a record of your income and expenses. You also need to keep documents, such as receipts and sales slips, that can help prove a deduction. In this section, you will find guidance about basic records that everyone should keep. The section also provides guidance about specific records you should keep for certain items. Electronic records. All requirements that apply to hard copy books and records also apply to electronic storage systems that maintain tax books and records. When you replace hard copy books and records, you must maintain the electronic storage systems for as long as they are material to the administration of tax law. For details on electronic storage system requirements, see Revenue Procedure 97-22, which is on page 9 of Internal Revenue Bulletin 1997-13 at IRS.gov/pub/irs-irbs/irb97-13.pdf.

Copies of tax returns. You should keep copies of your tax returns as part of your tax records. They can help you prepare future tax returns, and you will need them if you file an amended return or are audited. Copies of your returns and other records can be helpful to your survivor or the executor or administrator of your estate. If necessary, you can request a copy of a return and all attachments (including Form W-2) from the IRS by using Form 4506.

How Long To Keep Records You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. Generally, this means you must keep records that support items shown on your return until the period of limitations for that return runs out. The period of limitations is the period of time in which you can amend your return to claim a credit or refund or the IRS can assess additional tax. Following is the table which contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period beginning after the return was filed. Returns filed before the due date are treated as being filed on the due date

Period of Limitations

IF you... THEN the period is... 1 File a return and (2), (3), and (4) don't apply to you, 3 years. 2 Don't report income that you should and it is more than 25% of the gross income shown on your return, 6 years. 3 File a fraudulent return, No limit. 4 Don't file a return, No limit. 5 File a claim for credit or refund after you filed your return, The later of 3 years or 2 years after tax was paid. 6 File a claim for a loss from worthless securities or bad debt deduction, 7 years.

Record Keeping for Property

Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition. You must keep these records to figure your basis for computing gain or loss when you sell or otherwise dispose of the property. Generally, if you received property in a nontaxable exchange, your basis in that property is the same as the basis of the property you gave up. You must keep the records on the old property, as well as the new property, until the period of limitations expires for the year in which you dispose of the new property in a taxable disposition.

Estimated Tax Payments:

safe harbor for higher income taxpayers. If your 2021 adjusted gross income was more than $150,000 ($75,000 if you are married filing a separate return), you must pay the smaller of 90% of your expected tax for 2022 or 110% of the tax shown on your 2021 return to avoid an estimated tax penalty. If you don't pay your tax through withholding, or don't pay enough tax that way, you may have to pay estimated tax. People who are in business for themselves will generally have to pay their tax this way. Also, you may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rent, and royalties. Estimated tax is used to pay not only income tax, but self-employment tax and alternative minimum tax as well.

Underpayment penalty. If you didn't pay enough tax during the year, either through withholding or by making estimated tax payments, you may have to pay a penalty. In most cases, the IRS can figure this penalty for you.

Who Must Pay Estimated Tax If you owe additional tax for 2021, you may have to pay estimated tax for 2022. You can use the following general rule as a guide during the year to see if you will have enough withholding, or if you should increase your withholding or make estimated tax payments.

General rule. In most cases, you must pay estimated tax for 2022 if both of the following apply.

1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits.

2. You expect your withholding plus your refundable credits to be less than the smaller of: a. 90% of the tax to be shown on your 2022 tax return, or b. 100% of the tax shown on your 2021 tax return

When To Pay Estimated Tax For estimated tax purposes, the tax year is divided into four payment periods. Each period has a specific payment due date. If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you are due a refund when you file your income tax return. The payment periods and due dates for estimated tax payments are shown next. For the period: Due date:* Jan. 1–March 31 ...... April 18 April 1–May 31 ....... June 15 June 1–August 31 ..... Sept. 15 Sept. 1–Dec. 31 ...... Jan. 17, next year

ITIN NUMBER

Taxpayer Identification Number Requirements You must have a TIN by the due date of your return. If you, or your spouse if filing jointly, don’t have an SSN or ITIN issued on or before the due date of your 2021 return (including extensions), you can’t claim the RCTC, NCTC, ODC, or ACTC on either your original or amended 2021 tax return. If you apply for an ITIN on or before the due date of your 2021 return (including extensions) and the IRS issues you an ITIN as a result of the application, the IRS will consider your ITIN as issued on or before the due date of your return. Each qualifying child you use for RCTC, NCTC, or ACTC must have the required SSN. If you have a qualifying child who doesn’t have the required SSN, you can’t use the child to claim the RCTC, NCTC, or ACTC on either your original or amended 2021 tax return. The required SSN is one that is valid for employment and is issued before the due date of your 2021 return (including extensions).

If your qualifying child was born and died in 2021 and you don’t have an SSN for the child, attach a copy of the child’s birth certificate, death certificate, or hospital records. The document must show the child was born alive.

If your qualifying child doesn’t have the required SSN but has another type of TIN issued on or before the due date of your 2021 return (including extensions), you may be able to claim the ODC for that child. See Credit for Other Dependents (ODC), later. Each dependent you use for the ODC must have a TIN by the due date of your return.

If you have a dependent who doesn’t have an SSN, ITIN, or ATIN issued on or before the due date of your 2021 return (including extensions), you can’t use that dependent to claim the ODC on either your original or amended 2021 tax return. If you apply for an ITIN or ATIN for the dependent on or before the due date of your 2021 return (including extensions) and the IRS issues the ITIN or ATIN as a result of the application, the IRS will consider the ITIN or ATIN as issued on or before the due date of your return.

CAUTION ! Schedule 8812 (Form 1040) 8862 Improper Claims If you erroneously claim the RCTC, NCTC, ACTC, or ODC, and it is later determined that your error was due to reckless or intentional disregard of the RCTC, NCTC, ACTC, or ODC rules, you will not be allowed to claim any of these credits for 2 years. If it is determined that your error was due to fraud, you will not be allowed to claim any of these credits for 10 years. You may also have to pay penalties. Form 8862 may be required. If your RCTC, NCTC, ACTC, or ODC for a year after 2015 was denied or reduced for any reason other than a math or clerical error, you must attach Form 8862 to your tax return to claim the RCTC, NCTC, ACTC, or ODC, unless an exception applies. See Form 8862, Information

To Claim Certain Credits After Disallowance, and its instructions for more information, including whether an exception applies.

Advance Child Tax Credit Payments and Additional Tax Beginning in July and through December 2021, the IRS issued advance payments of the 2021 RCTC to taxpayers with qualifying children. The advance payments were early payments of 50% of the amount of RCTC estimated to be claimed on the 2021 tax return based on information from either a 2019 or 2020 tax return, including information provided to the IRS through an online non-filer tool to receive economic impact payments or advance child tax credit payments, and information provided in the child tax credit update portal on IRS.gov/CTCPortal. Changes throughout the year, such as a change in filing status or change in the number of qualifying children, could impact the amount of child tax credit you are eligible to receive on your 2021 tax return. You may not have received advance child tax credit payments if you unenrolled from receiving the payments. If you received advance child tax credit payments during 2021 but the amount of the credits you are eligible for on your 2021 tax return are less than what you received, you may owe an additional tax. See Schedule 8812 (Form 1040) and its instructions for more information.

Letter 6419 The IRS will issue Letter 6419, which will report the total amount of advance child tax credit payments issued to you and the number of qualifying children the IRS used to figure your advance child tax credit payments. You will need Letter 6419 to figure the amount of child tax credit to claim on your tax return or the amount of additional tax you must report. If you did not receive Letter 6419, go to the child tax credit update portal at IRS.gov/CTCPortal or call 800-908-4184 to get the information needed. See Schedule 8812 (Form 1040) and its instructions for more information

Child Tax Credit and Credit for Other Dependents Married filing jointly. If you filed as married filing jointly on your prior-year return, then both you and your spouse will receive a Letter 6419.

New Higher Estate And Gift Tax Limits For 2022: Couples Can Pass On $720,000 More Tax Free

Gift Tax Exclusion

The annual exclusion for federal gift tax purposes jumps to $16,000 for 2022, up from $15,000 in 2021.

Estate Tax

If you want to do better planning about gifts and estate, please read the following changes for 2022, gives you better understanding and computation of the gift and estate taxes:

The official estate and gift tax exemption climbs to $12.06 million per individual for 2022 deaths, up from $11.7 million in 2021, according to new Internal Revenue Service inflation-adjusted numbers. And the gift tax annual exclusion amount jumps to $16,000 for 2022, up from $15,000 where it’s been stuck since 2018.

The new numbers essentially mean that wealthy taxpayers can transfer more to their heirs tax free during life—or at death. A lot more.

The IRS announced the new inflation-adjusted numbers in Rev. Proc. 2021-45. We have all the details on 2022 tax brackets, standard deduction amounts and more —including for trusts & estates. For 2022 the retirement account limits, including the higher $61,000 overall 401(k) contribution limit, too.

The estate tax is assessed at 40% on the biggest estates. By transferring wealth to heirs early, the rich can avoid the estate tax. They do so by making big gifts—typically in the millions that eat up the $12 million exemption amount—and by making lots of $16,000 annual exclusion gifts that don’t count against the $12 million.

In 2022, an individual can leave $12.06 million to heirs and pay no federal

estate or gift tax, while a married couple can shield $24.12 million. For a couple who already maxed out lifetime gifts, the new higher exemption means that there’s room for them to give away another $720,000 in 2022.

“We always prefer clients make lifetime gifts rather than waiting to die and use the exemption at death because when you’re making a lifetime gift you’re really leveraging that exemption amount,” says Toni Ann Kruse, an estate lawyer with McDermott Will & Emery. Example: Make a $10 million gift today. Assets worth $10 million are out of your estate, and any growth on the $10 million is outside of your estate.

Separately, you can give away $16,000 to as many individuals—kids, grandkids, their spouses—as you’d like with no federal gift tax consequences. Spouses can each make $16,000 gifts, doubling the impact. A series of $16,000 annual exclusion gifts can add up, and they don’t count toward the $12 million exemption amount. “We always encourage our clients to make annual exclusion gifts,” says Kruse. “Do it annually.” And make those gifts as soon as possible rather than waiting until the end of the year. Why? You’re betting on any appreciation happening outside of your estate.

You also can make unlimited direct payments for medical and tuition expenses for as many people as you’d like, with no gift or estate tax consequences. “Those can be very powerful,” Kruse says.

For the wealthy making big gifts, there are many ways to get money out of their estate: outright gifts, loans to family members and special trusts. “Many of our clients have started and completed these gifts. If you’re thinking about it, get busy now,” says Joan Crain, Global Family Wealth Strategist at BNY Mellon Wealth Management. In any case, she insists, check that your basic estate plan documents are up to date: a will and/or revocable living trust, a durable power of attorney, a healthcare directive and a living will.

The $12 million estate tax exemption is set to be cut in half at the start of 2026. The 2017 Tax Cuts and Jobs Act temporarily doubled the estate tax exemption from 2018 through 2025, so it went from $5.49 million in 2017 to $11.17 million in 2018, indexed for inflation. This year, an early version of the Build Back Better Act included a provision that would have cut the exemption in half, but it was dropped from the latest November 3 legislative text. The Joint Committee of Taxation estimated the provision would raise $54.3 billion over ten years, with most of the revenue gain in the first five years, because of the 2025 sunset of the doubled exemption.

Another reason to make gifts: If you live in one of the 17 states or the District of Columbia that levy separate estate and/or inheritance taxes, there’s even more at stake, with death taxes sometimes starting at the first dollar of an estate.