New Changes for 2018

New Changes for 2018

The Tax Jobs and Cuts Act of 2017, signed into law by President Trump on December 22, 2017. Few important tax matters and major changes under new tax laws are briefly described.

New Changes

The major changes are for the tax year 2018 beginning January 1, 2018 are about Alimony deductions, moving expenses, student loan interest, kiddie tax, 529 plan, health insurance penalty, tax credits, itemized deductions and bigger standard deductions and much more ……

Alimony Becomes Tax Free from 2019, not from 2018

A big change is coming for divorce. In the past, alimony paid under a divorce decree was deductible by the ex-spouse who paid it and treated as taxable income by the recipient. Starting with alimony paid under divorce or separation agreements executed after December 31, 2018, the reverse will be true: Payors will no longer get to deduct alimony, but the payments will be tax-free for the ex-spouse who receives them. (That’s the same rule that has and will continue to apply to child support payments.)

Moving Expenses Deduction is No Longer Available

The new law eliminates a popular deduction for moving expenses. The deduction, which was available to itemizers and non-itemizers, allowed taxpayers to deduct the cost of a job-related move. Going forward, only members of the military can claim it.

Student Loan Interest

As under the old law, you can continue deduct up to $2,500 a year of interest paid on student loans. This write-off can be claimed by those who take the standard deduction, but it phases out at higher income levels. Also, tuition waivers and discounts received by graduate students retain their tax-free status.

The new law also declares that, if a student loan is discharged due to the borrower’s death or permanent disability, the amount forgiven will no longer be considered taxable income.

Kiddie Tax gets more teeth

The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24. Unearned income is income from sources other than wages and salary, like dividends and interest. Taxable income attributable to net unearned income will be taxed according to the brackets applicable to trusts and estates (see above, earlier). With respect to earned income, the rules are the same as before.

Under the old law, investment income over a modest amount earned by dependent children under the age of 19 (or 24 if a full-time student) was generally taxed at the parents’ rate, so the tax rate would vary depending on the parents’ income. Starting in 2018, such income will be taxed at the same rates as trusts and estates, which are far different than the rates that apply to individuals. The top 37% tax rate in 2018 kicks in at $600,000 for a married couple filing a joint return, for example. That same rate kicks in at $12,500 for trusts and estates ... and, now, the kiddie tax, too.

But that doesn’t necessarily mean higher taxes for a child’s income that falls victim to the kiddie tax. Consider, for example, a situation in which a child has $5,000 of income subject to the kiddie tax and that the parents have taxable income of $150,000. In 2017, applying their 25% rate to the $5,000 would have cost $1,250. If the old rules still applied, using the parents’ new 22% rate would result in an $1,100 tax on that $5,000 of income. Applying the new trust tax rates produces a kiddie tax bill of just $843 on the child’s investment income.

The kiddie tax applies to investment income over $2,100 of children under age 19 or, if full-time students, age 24.

529 Plan – Changes

The new law allows families to spend up to $10,000 a year from tax-advantaged 529 savings plans to cover the costs of K-12 expenses for a private or religious school. Previously, tax-free distributions from those plans were limited to college costs.

Expanded ABLE Accounts

The law expands the uses of these tax-advantaged accounts, which allow families to put aside up to $14,000 a year to cover expenses for a beneficiary with special needs. The money can be used tax-free for most expenses, and account assets of up to $100,000 don’t count toward the $2,000 limit for Supplemental Social Security Income benefits. Under the new law, ABLE beneficiaries will be allowed to contribute their own earnings to the account once the $14,000 contribution limit for gifts by others has been reached.

The law also allows parents and others who established a 529 plan for a disabled beneficiary to roll the money into an ABLE account for that individual. However, the rollover would count toward the $14,000 annual contribution limit.

Penalties for not having Health Insurance

The new law repeals the “individual mandate” – the requirement under the Affordable Care Act (aka Obamacare) that demands that you have health insurance or pay a fine. But not until 2019. For 2018, the mandate is still in place.

Bigger Standard Deductions and but NO Personal Exemptions

standard deduction increased to $12,000 on single returns, $18,000 for head-of-household filers and $24,000 on joint returns … up from $6,350, $9,350 and $12,700 in 2017.

As under the old law, individuals age 65 or older and blind people get even higher standard deductions. Two 65-year-olds filing a joint return, for example, would add $2,600 to the $24,000 standard deduction, for a total of $26,600. An individual taxpayer age 65 or older would add $1,600, bringing the standard deduction to $13,600.

Tax Relief for Pass Through Income

The new law slashes the tax rate on regular corporations (sometimes referred to as “C corporations”) from 35% to 21%, starting in 2018. The law offers a different kind of relief to individuals who own pass-through entities—such as S corporations, partnerships and LLCs—which pass their income to their owners for tax purposes, as well as sole proprietors who report income on Schedule C of their tax returns. Starting in 2018, many of these taxpayers can deduct 20% of their qualifying income before figuring their tax bill. For a sole proprietor in the 24% bracket, for example, excluding 20% of income from taxation has the same effect of lowering the tax rate to 19.2%.

The changes to the taxation of passthrough businesses are some of the most complex provisions in the new law, in part because of lots of limitations and anti-abuse rules. They’re designed to help prevent gaming of the tax system by taxpayers trying to have income taxed at the lower passthrough rate rather than the higher individual income tax rate. For many pass-through businesses, for example, the 20% deduction phases out for taxpayers with incomes in excess of $157,500 on an individual return and $315,000 on a joint return. At the end of the day, most individuals who are self-employed or own interests in partnerships, LLCs or S corporations will pay less tax on their passthrough income than in the past.

Large corporations are the big winners, with major cuts to the corporate tax rate. Most of us aren’t large corporations, but there is a significant change that helps small business owners as well. There is now a potential 20% pass-through deduction that starts this year for the self-employed, sole proprietors, S corporations and partnerships. As a pass-through entity, an S corp does not have to pay taxes on its corporate income. All profits flow through to the owners.

For certain professions, there are income limitations in order to receive the full 20% pass-through deduction. For service industry professionals like doctors, lawyers, and even financial planners, their income must be below $207,500 (singles) or $415,000 (married) for that person to benefit from any of the new pass-through deduction.

1031 Exchange – like kind Exchanges Survives… only for Real Estates

Generally, an exchange of property is a taxable transaction, just like a sale. But the law includes an exception when investment or business property is traded for similar property. Any gain that would be triggered by the sale of such property is deferred in the case of a like-kind exchange. This break has applied to assets such as real estate and tangible personal property such as heavy equipment and artwork.

Going forward, though, the new law restricts its use to like-kind exchanges of real estate, such as trading one rental property for another. It’s estimated that the change will cost affected taxpayers more than $30 billion over the next ten years

Recharacterization of Traditional to Roth IRA- back door treatment

The new law will make it riskier to convert a traditional individual retirement account to a Roth. The old rules allowed retirement savers to reverse such a conversion—and eliminate the tax bill—by “recharacterizing” the conversion by October 15 of the following year. That could make sense if, for example, the Roth account lost money. The move allowed savers to avoid paying tax on money that had disappeared. Starting in 2018, such do-overs are done for. Conversions are now irreversible.

401K Borrower – Relief for some 401K Plans Borrowers

The new law would give employees who borrow from their 401(k) plans more time to repay the loan if they lose their jobs or their plan is terminated. Currently, borrowers who leave their jobs are usually required to repay the balance in 60 days to avoid having the amount outstanding treated as a taxable distribution. Under the new law, they will have until the due date of their tax return for the year they left the job.

Foreign Earned Income Exclusion

If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gifttax returns and paying estimated tax are generally the same whether you are in theUnited States or abroad. Your worldwide income is subject to U.S. income tax, regardless of where you reside.

The foreign earned income exclusion prevents double taxation by excluding theincome from U.S, taxation. The United States will tax your income earned worldwide. However, if you are an American expat, this means you are taxed twice on thisincome. To qualify for the exclusion, you'll need to meet a number of criteria. You must work and reside outside the U.S. and meet either the bona fide resident or physical presence test.Generally, to meet the physical presence test, you must be physically present in a foreign country or countries for at least 330 full days during the 12-month period. You can count days you spent abroad for any reason.

For tax year 2018, the foreign earned income exclusion is $104,100, up from $102,100 for tax year 2017.

You CAN claim the foreign earned income exclusion and the foreign housing exclusion or the foreign housing deduction.

To read more please visit https://www.irs.gov/forms-pubs/about-form-2555

TAX CREDITS

The new law would give employees who borrow from their 401(k) plans more time to repay the loan if they lose their jobs or their plan is terminated. Currently, borrowers who leave their jobs are usually required to repay the balance in 60 days to avoid having the amount outstanding treated as a taxable distribution. Under the new law, they will have until the due date of their tax return for the year they left the job.

Higher Child Tax Credit

Starting in 2018, the $1,000 tax credit for each child under age 17 is doubled to $2,000. For lower-income taxpayers, up to $1,400 of the credit is refundable, meaning that if the credit pushes your tax liability below $0, the IRS will write you a refund check of up to $1,400 per eligible child. The credit begins to phase out for couples with adjusted gross incomes over $400,000 (up from $110,000 in 2017) and $200,000 for all other filers (up from $75,000).

Credits for Other Dependents

For parents, siblings & other dependents: In addition to the enhanced child tax credit, there is a new, nonrefundable credit of $500 for each dependent who is not a qualifying child including, for example, an elderly parent or disabled adult child. This credit would phase out under the same income thresholds.

The House of Representatives version of the tax overhaul wanted to scrap the credit for the elderly and the disabled, which is worth up to $1,125 to qualifying low-income taxpayers.

Dependent Care – Flexible spending account through employer

The House of Representatives called for preventing working parents from setting aside pre-tax money in dependent care flexible savings accounts to pay for child care costs. The Senate blocked the effort, so the tax break remains in the law. Parents can continue to set aside up to $5,000, pre-tax, in these accounts. The money can be used to cover the cost of care of children under age 13 so that the parents can work.

Few points keep in mind:

Earned Income Tax Credit (EITC)

For 2018, the maximum EITC amount available is $6,431 for taxpayers filing jointly who have three or more qualifying children. Income phaseouts apply. For more info, IRB 2018-10 has a table providing maximum credit amounts for other categories, income thresholds, and phaseouts.

Electric Vehicle Credit

It also unplugged the credit for plug-in electric vehicles, which is worth of up $7,500. The Senate refused to go along, though, so both tax breaks will continue.

Itemized Deductions

The new law repeals the “individual mandate” – the requirement under the Affordable Care Act (aka Obamacare) that demands that you have health insurance or pay a fine. But not until 2019. For 2018, the mandate is still in place.

Medical Deductions

Despite efforts to eliminate the deduction for medical expenses, the new law is actually more generous than the old one. Under the old rules, medical expenses were deductible only to the extent they exceeded 10% of adjusted gross income. For 2017 and 2018, however, the threshold drops to 7.5% of AGI. Come 2019, the 10% threshold returns (unless Congress changes the rules again)

Keep in mind this medical deduction is only benefit if taxpayer is itemizing and sum of all his deductions, after meeting the limitations within the itemized deduction computation, would get exceed the standard deduction limits.

Mortgage Interest Deductions: Primary Home owners tax break squeezed

Lawmakers decided to reduce – from $1,000,000 to $750,000 – the amount of debt on which homeowners can deduct mortgage interest. The limit applies to mortgage debt incurred after December 15, 2017, to buy or improve a principal residence or second home. Older loans are still subject to the $1 million cap.

The law also bans the deduction of interest on home-equity loans. And this change applies to both old and new home-equity debt. Interest accrued on home-equity debt after December 31, 2017, is not deductible.

Deduction for State & Local taxes and Property Taxes

Salt and Real Estate Tax Deductions

Starting in 2018, the law sets a $10,000 limit on how much you can deduct of the state and local taxes you pay. A plan to limit the write-off to property taxes only was scrapped. You can deduct any combination of state and local income or sales taxes or property taxes, up to the $10,000 cap.

Casualty Losses

Going forward, the new law greatly restricts the opportunity for individuals who suffer unreimbursed casualty losses from sharing the pain with Uncle Sam. Under the old rules, such losses were deductible by those who itemize to the extent the loss exceeded $100 plus 10% of their adjusted gross income. Starting in 2018, the law allows a deduction of such losses only if they occur in a presidentially declared disaster area.

There’s the opposite of a crackdown for 2016 and 2017 losses in presidentially declared disaster areas, though. The new law permits individuals who suffered such losses to deduct the loss without reducing the write-off by 10% of adjusted gross income. To be deductible under this rule, the loss must exceed $500. Also, for covered losses, the deduction is available even for those who claim the standard deduction.

Employee Unreimbursed expenses

The new law also repeals all miscellaneous itemized deductions subject to the 2% of AGI threshold, including the write-off for tax preparation fees, unreimbursed employee business expenses and investment fees.

Commuter Benefits – Squeezed

The new law eliminates, starting in 2018, the rule that allows employers to deduct up to $260 a month per employee for the cost of transportation-related fringe benefits, such as parking and transit passes. Employees can still use pre-tax money to cover such expenses, but employer subsidies may dry up. The new law also hits the bicycle commuter benefit that had allowed employers to provide employees up to $20 a month to cover bike-related expenses—that money's now taxable to the employee.

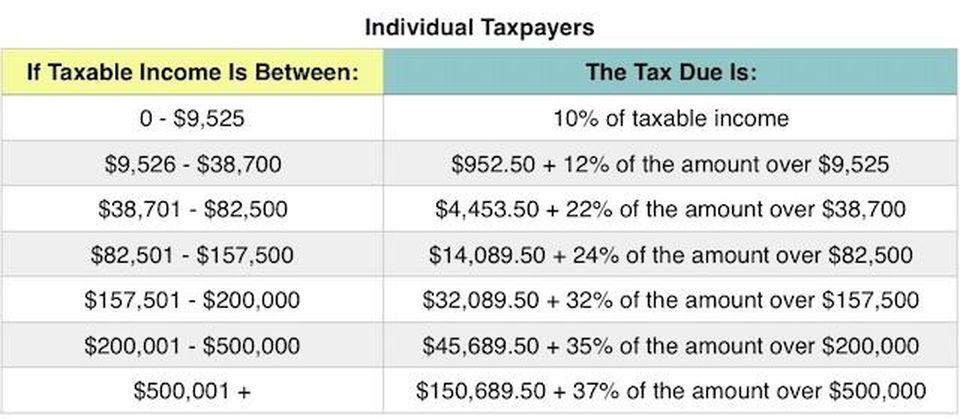

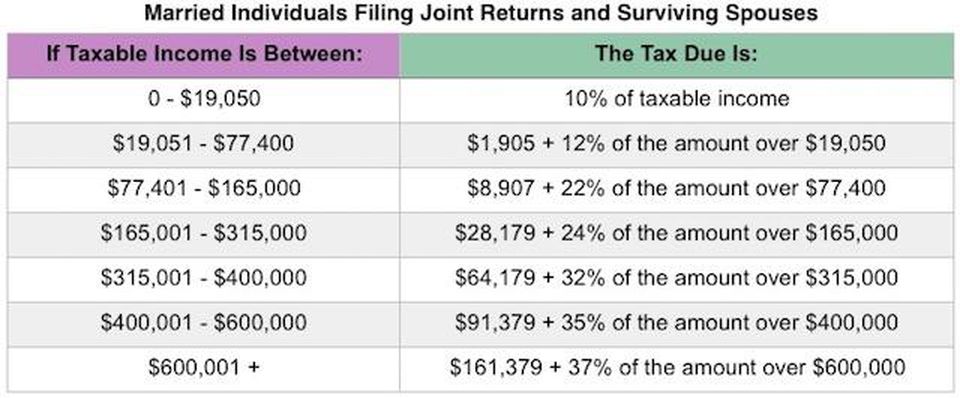

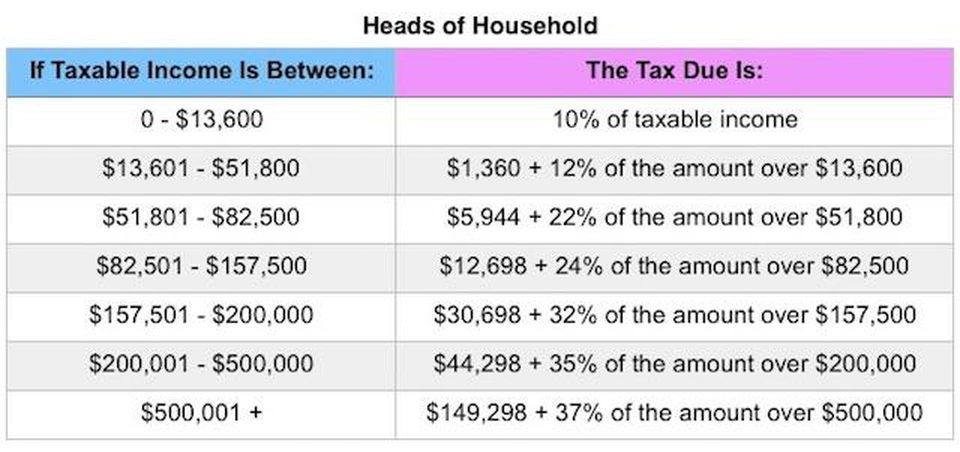

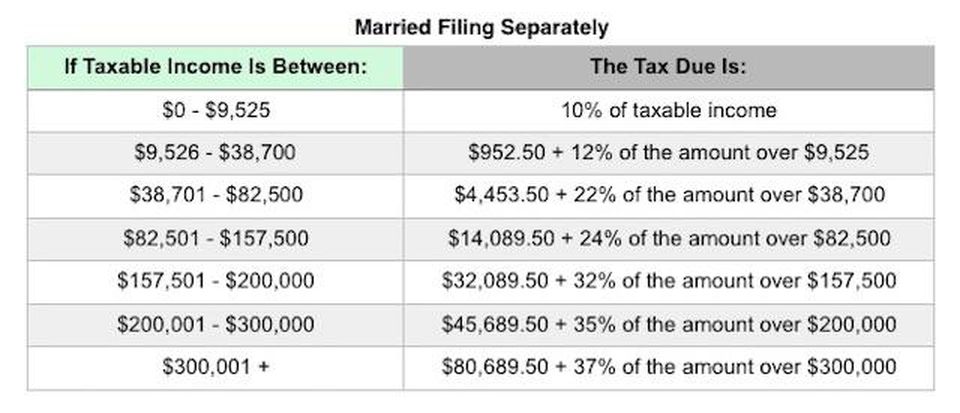

Tax Rates for Individual

Tax Brackets and Tax Rates

The big news is, of course, the tax brackets and tax rates for 2018. There are still seven (7) tax rates. They are: 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a Zero Rate) Here's how those break out by filing status: